How much can a person borrow for a mortgage

A mortgage would allow you to make that 30000 payment while a lender gives. Our competitive options help you with mortgages in excess of 424100.

Investing Calculator Borrow Money

DSR Commitment Income.

. You will both enter into arrears meaning it will be much harder to secure a mortgage or any form of credit moving forward. How much income do I need for a 200k mortgage. Any person who is of 60 years or more can avail the reverse mortgage scheme.

Whatever the amount make sure youre comfortable with it and able to provide it quickly. The most important factor that determines how much you can borrow is your income no surprises there. Who can avail this facility.

For example 5 of 1 million will always be a larger amount than 5 of 500000. 6 How much money can you loan a family member. If your relative doesnt agree with your terms you dont have to lend them money.

The amount you borrow. 548250 2-4 units can be higher Yes if. The DSR is meant to show how much of a persons income is used to service debt instalments and is represented as a percentage of income.

The more you borrow from your bank the more interest youll need to repay. In case of a married couple at least one of them should be 60 years of age or more. Subject to certain conditions you can take out a mortgage when you receive your income in a currency other than the euro.

The amount of your deposit. If you both decide to transfer a joint mortgage to one person this is possible through a legal process known as a transfer of equity. Theyre also able to put down 15 on the house.

Between different banks there can be major differences in the final DSR amount that is calculated. But when you advance a sum of money to a family member youre already. It is derived from 2 main components.

By comparing mortgage rates you can see how the lower your home loans interest rate the more you can save in home loan interest charges over time. Before you invest 200k into a home youll want to be sure you can afford it. For example you probably cant pay 400000 for a home upfront however maybe you can afford to pay 30000 upfront.

In general lenders do not like more than 60 of a persons income going toward their mortgage and monthly outgoings. A mortgage is all about customisation so the way you earn your income affects how much you can borrow. You can also connect with a home mortgage consultant and have a conversation about your home financing needs your loan choices and how much you may be able to borrow.

New customers can qualify for up to 800 and existing customers for as much as 1500 with a fast cash loan from Fish4Loans. How much could you potentially borrow for your mortgage. You can use the above calculator to estimate how much you can borrow based on your salary.

Our rates can help you save on a mortgage refinance. How much can you borrow for a mortgage in the Netherlands. The house to be mortgaged should have a residual life of at least 20 years or more.

Thats about two-thirds of what you borrowed in interestIf you instead opt for a 15-year mortgage youll pay over the life of your loan or about half of the interest youd pay on a 30-year mortgage. If that doesnt fit your finances a high-ratio mortgage may be available with a down payment of at least 5. Quickcash small loan review Apply today for a small short term loan.

Please note that the values provided can only be taken as an estimate of the amount to be borrowed. The outstanding loan amount. To be able to avail this scheme the applicant needs to own the house.

For example imagine you have 20 years left on your mortgage and you refinance from a. If you have a variable interest rate paying attention to the federal funds rate can help you predict what your interest rate will do. This is part of your down payment paid when you make an offer.

But this persons credit score is 700 and they only pay 250 in non-mortgage debts each month. While mortgage lenders prefer your DTI ratio not exceed 36 percent in many cases lenders can accept a maximum of 43 percent this is still within the range of whats known as a qualified. There is no other option than to borrow from a family member.

The million-dollar question more like a 300000 question really. 20 down Learn More. The income you need is calculated using a 200k mortgage on a payment that is 24 of your monthly income.

Your total interest on a 600000 mortgage. That nobody mentions the fact that the age of the person has an effect on mortgages in the Netherlands. Find financial calculators mortgage rates mortgage lenders insurance quotes refinance information home equity loans credit reports and home finance advice.

100K salary and good credit buys a home above 500K. Our home loan borrowing power calculator could help you work out what you may be able to afford to borrow from a financial institution based on your income and expenses. If you choose to use lenders mortgage insurance to increase your borrowing power you can choose to add it to the loan balance though keep in mind this means youll pay interest on it.

On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. When youre ready your home mortgage consultant will help you complete an application. Can a Joint Mortgage be Transferred to One Person.

You can also input your spouses income if you intend to obtain a joint application for the mortgage. Find a local consultant. Plan for an amount of at least 20 of the purchase price.

Look at different family mortgage loan agreements for reference. I receive my income in a currency other than the euro can I still get a mortgage. Lenders mortgage insurance is an insurance cover that protects a lender if you cant meet required mortgage repayments and default on your loan.

1500000 primary Yes if. Get a call back. To be able to borrow a 200k mortgage youll require an income of 61525 per year.

20 down Learn More.

Self Employed Mortgage How Much Can I Borrow The Borrowers Self Mortgage

Are Mortgage Rates Lower On Mondays Finance Guide Mortgage Rates Mortgage

Top 5 Reasons People Take Out Personal Loans Personal Loans Unsecured Loans Person

12 Things Canadians Don T Know About Second Mortgages Canadian Mortgages Inc

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Pre Qualified And Pre Approved Are Two Different Things Mortgage Companies People Pre

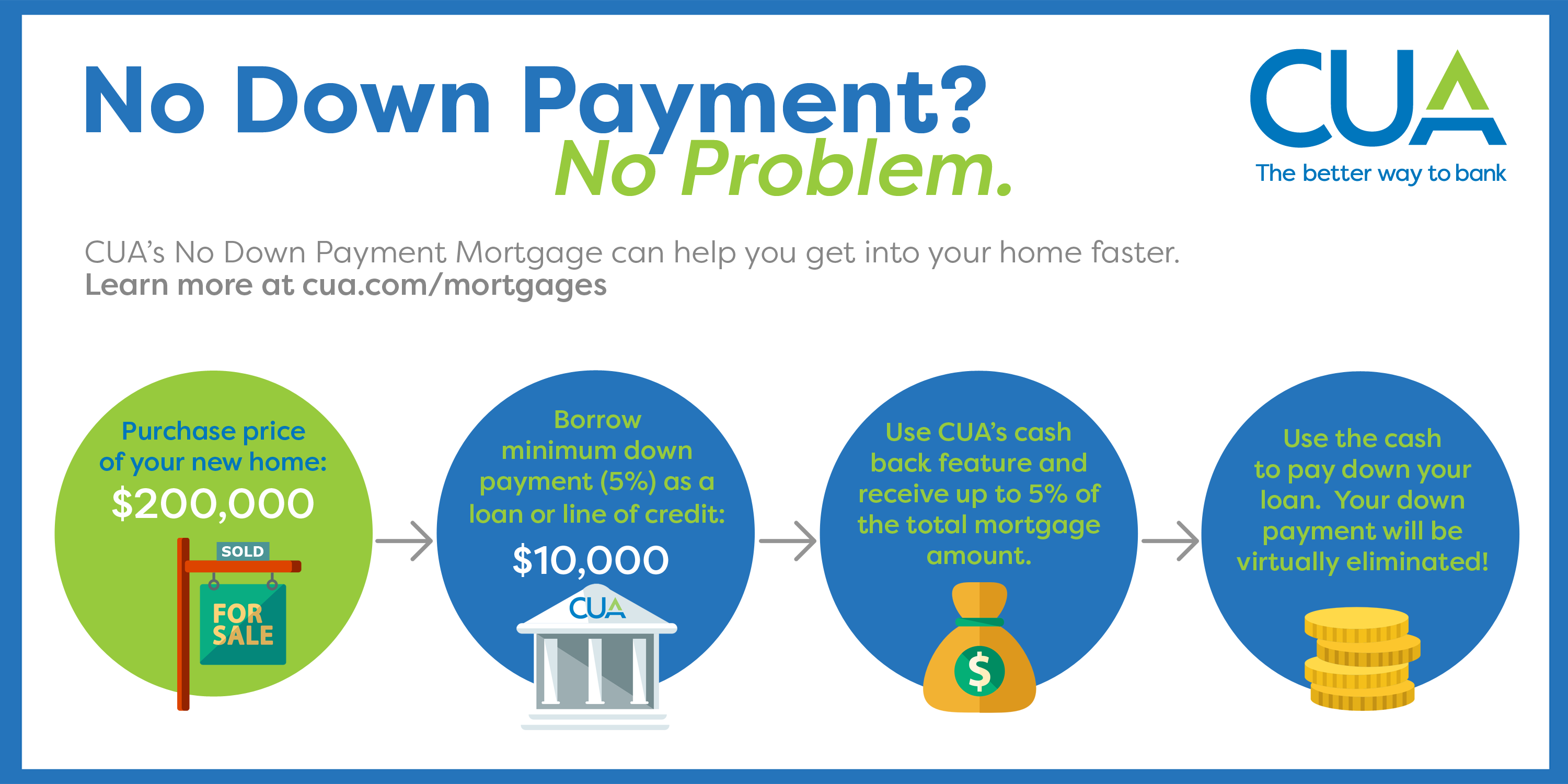

Cua The No Down Payment Mortgage

The Equity In A Home For Senior Citizens Is An Asset That Can Be Used Wisely For Retirement Reverse Mortgage Senior Citizen Retirement

Ssjtafrpq7xz M

A Home Loan Or Mortgage Is When You Borrow Money From Another Person Or Institution To Pay For A Property Gettos In 2022 The Borrowers Borrow Money Home Loans

Interested In Borrowing Against Your Home S Available Equity To Pay For Other Expenses The Good News Is You Have Ch Home Equity Line Of Credit Mortgage Payoff

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

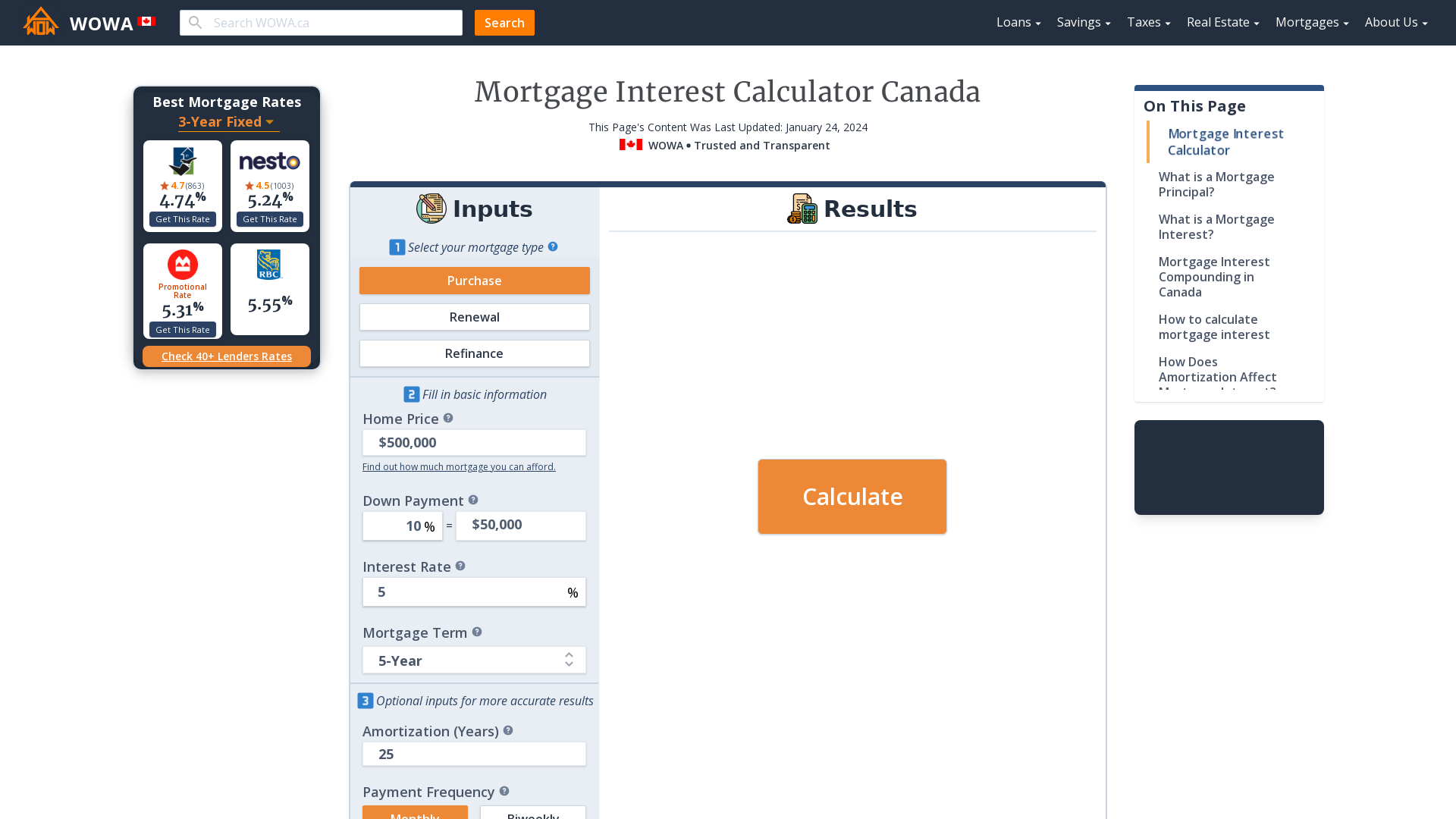

Mortgage Affordability Calculator 2022

Borrow Money Contract Template Beautiful Sample Lending Contract Sample Contract Template For Contract Template Agreement Contract

Cua The No Down Payment Mortgage

Infographic 10 Steps To Buying A Home In The Uk Home Buying Infographic 10 Things

How To Borrow Money For A Down Payment Loans Canada